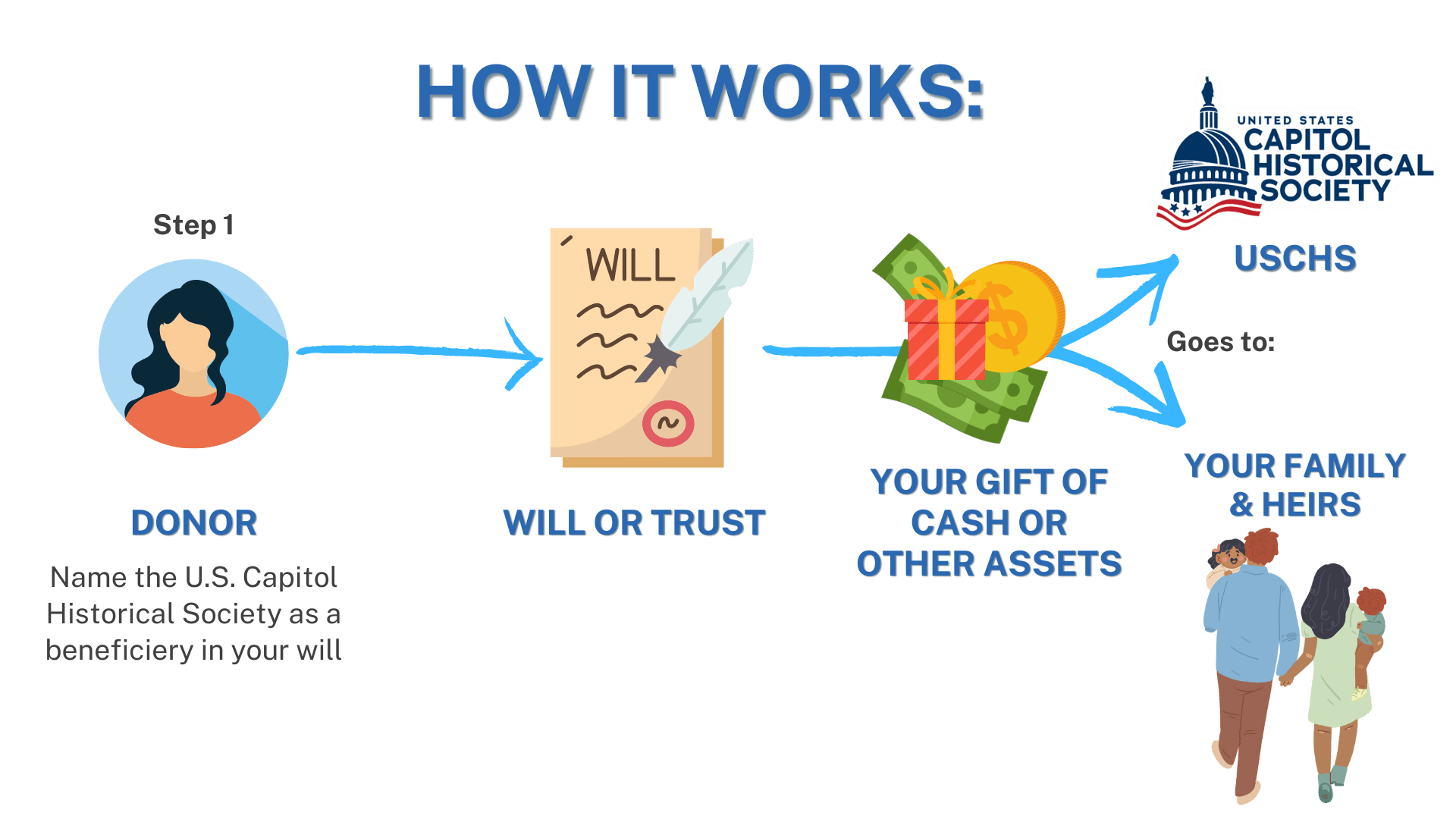

If you want to make a lasting impact and support the programs that matter most to you, consider including a gift to USCHS in your long-term estate or financial plans. With many options available to choose from, you can help ensure that future generations can benefit from the programs you value. Only with a will or living trust can you ensure that your loved ones will be provided for and that your charitable goals will be met.

You can continue to support the causes you care about most by choosing to give through your will:

- A percentage of your estate.

- A specific amount.

- Specific property such as stocks, bonds, or real estate.

- Part or all of the residue of your estate (what is left after all beneficiaries have received their bequests).

- A blended bequest- a specific amount plus a percentage or all of the residue.

Example: Mr. and Mrs. Morris have been long-time supporters of a favorite charity and want to continue supporting it after they are gone. In their wills, the couple stipulates that the charity receives a percentage of the remainder of their estate after their loved ones have been provided for.

Sample Bequest Language

I ______ hereby give, devise and bequeath to the U.S. Capitol Historical Society [tax ID # is 52-0796820], the sum of $ _____ (or ____ asset) to be used where it determines the need is greatest (or for the support of a specific fund or program).

Benefits:

- Modify at Any Time: Change your bequest or trust designation as needed.

- Lifetime Funding Control: Retain control over the funding property during your life.

- Tax-Free Designation: Your bequest or trust won’t be subject to federal estate tax, ensuring your intended beneficiaries receive the full benefit.

- Future Support for USCHS: By including USCHS in your bequest or trust, you contribute to its sustained support and impact.

To learn more or request a brochure, please contact cclark@uschs.org or call 202-543-8919 ext. 23. The tax ID number is 52-0796820.